Over 2 million + professionals use CFI to learn accounting, financial analysis, modeling and more. Unlock the essentials of corporate finance with our free resources and get an exclusive sneak peek at the first chapter of each course. Start Free

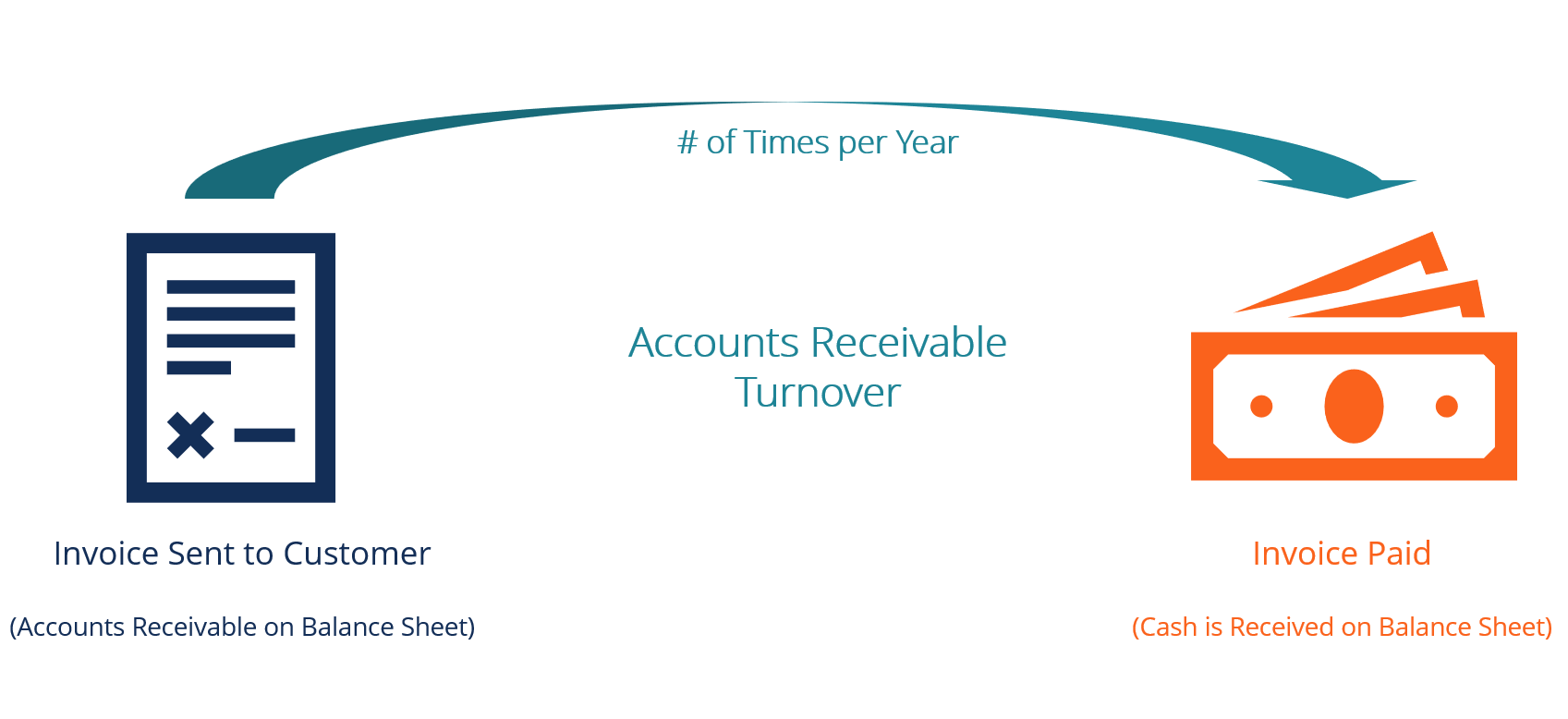

The accounts receivable turnover ratio, also known as the debtor’s turnover ratio, is an efficiency ratio that measures how efficiently a company is collecting revenue – and by extension, how efficiently it is using its assets. The accounts receivable turnover ratio measures the number of times over a given period that a company collects its average accounts receivable.

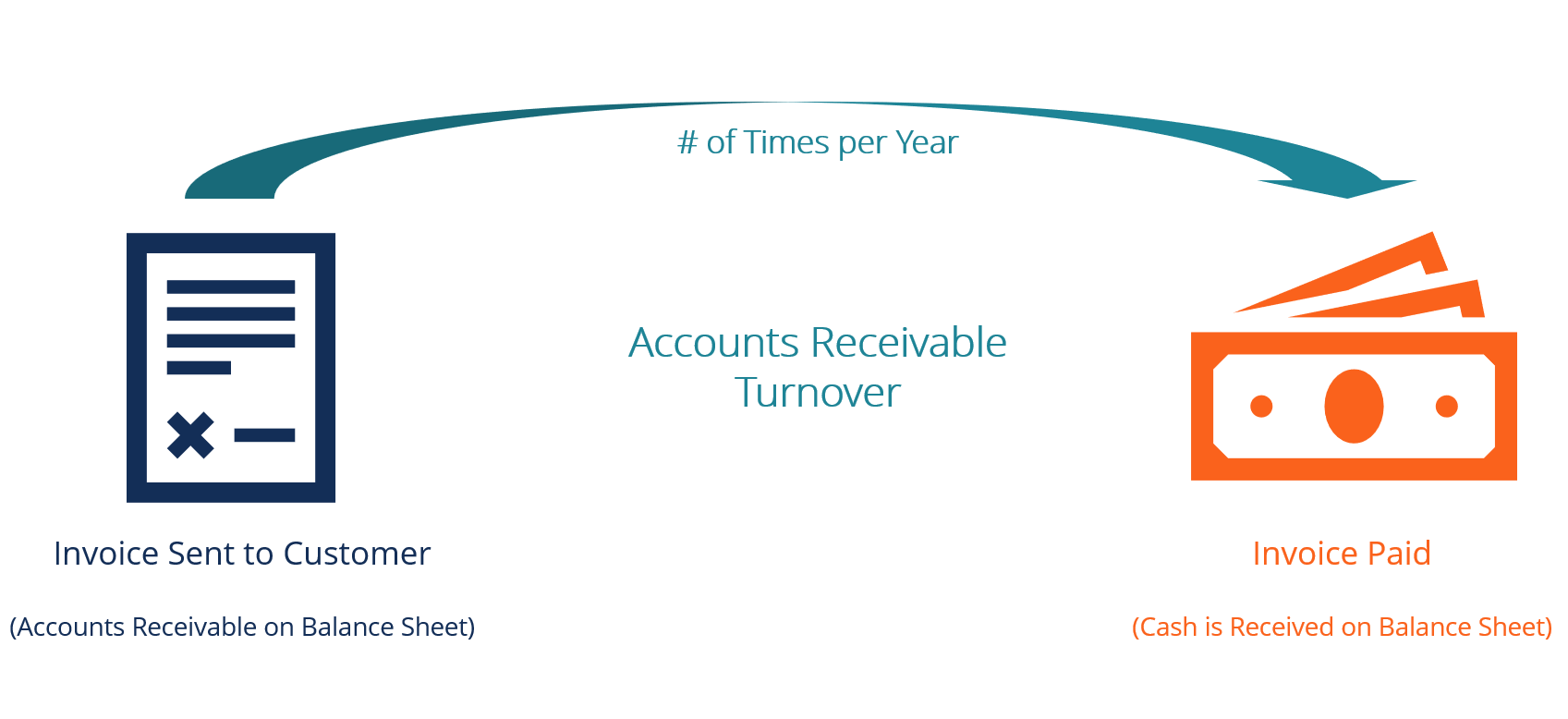

The accounts receivable turnover ratio formula is as follows:

Accounts Receivable Turnover Ratio = Net Credit Sales / Average Accounts Receivable

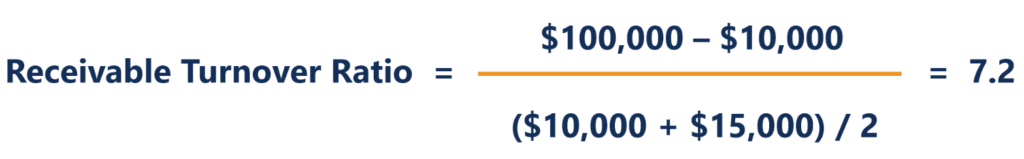

Trinity Bikes Shop is a retail store that sells biking equipment and bikes. Due to declining cash sales, John, the CEO, decides to extend credit sales to all his customers. In the fiscal year ended December 31, 2017, there were $100,000 gross credit sales and returns of $10,000. Starting and ending accounts receivable for the year were $10,000 and $15,000, respectively. John wants to know how many times his company collects its average accounts receivable over the year.

Therefore, Trinity Bikes Shop collected its average accounts receivable approximately 7.2 times over the fiscal year ended December 31, 2017.

The accounts receivable turnover in days shows the average number of days that it takes a customer to pay the company for sales on credit.

The formula for the accounts receivable turnover in days is as follows:

Receivable Turnover in Days = 365 / Receivable Turnover Ratio

Determining the accounts receivable turnover in days for Trinity Bikes Shop in the example above:

Receivable turnover in days = 365 / 7.2 = 50.69

Therefore, the average customer takes approximately 51 days to pay their debt to the store. If Trinity Bikes Shop maintains a policy for payments made on credit, such as a 30-day policy, the receivable turnover in days calculated above would indicate that the average customer makes late payments.

Enter your name and email in the form below and download the free template now!

Download the free Excel template now to advance your finance knowledge!

The accounts receivable turnover ratio is an efficiency ratio and is an indicator of a company’s financial and operational performance. A high ratio is desirable, as it indicates that the company’s collection of accounts receivable is frequent and efficient. A high accounts receivable turnover also indicates that the company enjoys a high-quality customer base that is able to pay their debts quickly. Also, a high ratio can suggest that the company follows a conservative credit policy such as net-20-days or even a net-10-days policy.

On the other hand, a low accounts receivable turnover ratio suggests that the company’s collection process is poor. This can be due to the company extending credit terms to non-creditworthy customers who are experiencing financial difficulties.

Additionally, a low ratio can indicate that the company is extending its credit policy for too long. It can sometimes be seen in earnings management, where managers offer a very long credit policy to generate additional sales. Due to the time value of money principle, the longer a company takes to collect on its credit sales, the more money a company effectively loses, or the less valuable are the company’s sales. Therefore, a low or declining accounts receivable turnover ratio is considered detrimental to a company.

It’s useful to compare a company’s ratio to that of its competitors or similar companies within its industry. Looking at a company’s ratio, relative to that of similar firms, will provide a more meaningful analysis of the company’s performance rather than viewing the number in isolation. For example, a company with a ratio of four, not inherently a “high” number, will appear to be performing considerably better if the average ratio for its industry is two.

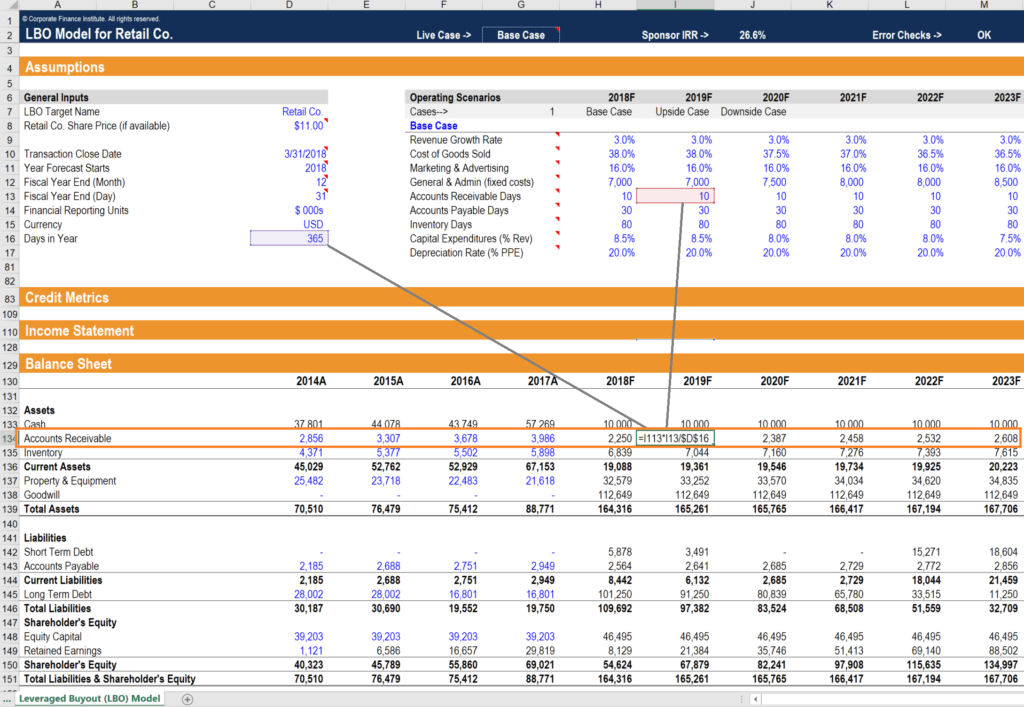

In financial modeling, the accounts receivable turnover ratio (or turnover days) is an important assumption for driving the balance sheet forecast. As you can see in the example below, the accounts receivable balance is driven by the assumption that revenue takes approximately 10 days to be received (on average). Therefore, revenue in each period is multiplied by 10 and divided by the number of days in the period to get the AR balance.

Days in a Financial Model" width="1024" height="707" />

Days in a Financial Model" width="1024" height="707" />

The above screenshot is taken from CFI’s Financial Modeling Course.

The main points to be aware of are:

Watch this short video to quickly understand the main concepts covered in this guide, including the commonly used accounts receivable efficiency ratios and the formulas for calculating the accounts receivable turnover ratio.

Thank you for reading this CFI guide to the Accounts Receivable Turnover Ratio. To learn more and expand your career, explore the additional relevant resources below.

Gain in-demand industry knowledge and hands-on practice that will help you stand out from the competition and become a world-class financial analyst.